- Mailing Lists

- Contributors

- tax_base_amount going to be deprecated. Anyone else using it?

Archives

- By thread 1419

-

By date

- August 2019 59

- September 2019 118

- October 2019 165

- November 2019 97

- December 2019 35

- January 2020 58

- February 2020 204

- March 2020 121

- April 2020 172

- May 2020 50

- June 2020 158

- July 2020 85

- August 2020 94

- September 2020 193

- October 2020 277

- November 2020 100

- December 2020 159

- January 2021 38

- February 2021 87

- March 2021 146

- April 2021 73

- May 2021 90

- June 2021 86

- July 2021 123

- August 2021 50

- September 2021 68

- October 2021 66

- November 2021 74

- December 2021 75

- January 2022 98

- February 2022 77

- March 2022 68

- April 2022 31

- May 2022 59

- June 2022 87

- July 2022 141

- August 2022 38

- September 2022 73

- October 2022 152

- November 2022 39

- December 2022 50

- January 2023 93

- February 2023 49

- March 2023 106

- April 2023 47

- May 2023 69

- June 2023 92

- July 2023 64

- August 2023 103

- September 2023 91

- October 2023 101

- November 2023 94

- December 2023 46

- January 2024 75

- February 2024 79

- March 2024 104

- April 2024 63

- May 2024 40

- June 2024 160

- July 2024 80

- August 2024 70

- September 2024 62

- October 2024 121

- November 2024 117

- December 2024 89

- January 2025 59

- February 2025 104

- March 2025 96

- April 2025 107

- May 2025 52

- June 2025 72

- July 2025 60

- August 2025 81

- September 2025 124

- October 2025 63

- November 2025 22

Contributors

OCA Days 2023 - Registrations, Call for Speakers and Functional Survey

Documentation on Management System module and its related sub-modules

tax_base_amount going to be deprecated. Anyone else using it?

tax_base_amount going to be deprecated. Anyone else using it?

- bank statements.

- on many banks operations (for eg. check deposits) we have expenses + taxes associated. So for on check deposit we may have 4 statement lines:

- check deposit (cash in)

- expense fee (cash out)

- tax 1 (based on the expense fee, cash out)

- tax 2 (based on the expense fee, cash out)

- On Odoo standard we're not able to reconcile that because we can't say that an statement line is 100% a tax In the odoo approach those two taxes should came from the tax being applied on the "expense fee"

- special invoice taxes

- we've some special invoice taxes where the base amount is not the subtotal of the invoice line but some specific computation (for ex. is the vat of that line)

- in that use case, we're storing the calculated base amount on tax_base_amount. Considering that the base amount is the sum of the subtotales of the lines where the tax is linked, is not correct.

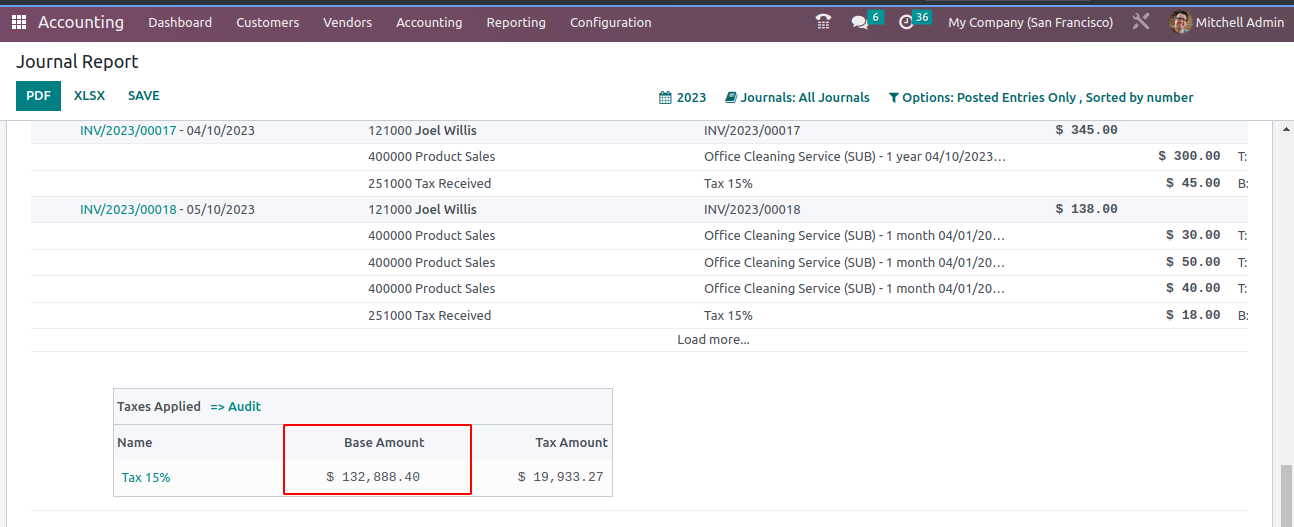

- On master (and I believe 16 two). Odoo has a similar use case for belgium. When you offer a cash discount, no matter if the customer use it or not, the vat is computed on the discounted price. That's why there is a new option on the payment terms and, only for having the right base amount on the invoice, odoo is creating virtual lines (check attachment)

- supplier bills

- It's really common to receive supplier bills with some specific taxes that are totalized and without information on which are the base lines.

- in those use cases creating just a tax line (as it was possible on v12-) would be really handy. Nowadays we're adding that tax on the first invoice line (arbitrary) and then editing the amount on the subtotal section. The computed base amount by odoo on reports doesn't represent anything.

- For us it would make much more sense to add the tax on subtotal by choosing: tax, base amount, and amount. And that would create the aml without any need of linked base lines with tax_ids

- We also have some specific needs related to payment withholdings. Summarizing, when you pay or get paid you receive or apply different kind of withholdings for different amounts.

- This is the ideal for us

# | account | tax_ids | tax_id | debit | credit | tax_base_amount |

1 | Suppliers | 1210 | ||||

2 | VAT withholding | VAT withholding | 21 | 210 | ||

3 | Proffits withholding type 1 | Proffits withholding type 1 | 60 | 600 | ||

4 | Proffits withholding type 2 | Proffits withholding type 2 | 80 | 400 | ||

5 | Cash | 1049 |

- This is the odoo proposal (to have all the base amounts computed by the tax base lines). Lines 6 till 11 are dummy lines just for the base amounts

# | account | tax_ids | tax_id | debit | credit | tax_base_amount |

1 | Suppliers | 1210 | ||||

2 | VAT withholding | VAT withholding | 21 | 210 | ||

3 | Profits withholding type 1 | Profits withholding type 1 | 60 | 600 | ||

4 | Profits withholding type 2 | Profits withholding type 2 | 80 | 400 | ||

5 | Cash | 1049 | ||||

6 | Base for VAT withholding | VAT withholding | 210 | |||

7 | Negative for base VAT withholding | 210 | ||||

8 | Base for Profits withholding type 1 | Profits withholding type 1 | 600 | |||

9 | Negative for Profits withholding type 1 | 600 | ||||

10 | Base for Profits withholding type 2 | Profits withholding type 2 | 400 | |||

11 | Negative for Profits withholding type 2 | 400 |

- We also know that in Brazil and some other countries, there are some webservices that returns the base amounts and taxes you need to apply to an invoice, Si in those use cases also the base amount of the tax may not be the sum of subtotals where the tax is applied

- Odoo is working on removint tax_base_amount and enforcing that every aml that represents a tax should be created by some aml with that tax. The base amount of the tax would be the sum of the base lines

- IMHO

- That approach could work but requires a lot of dummy lines (plus and negative) to represent all the possible combinations of tax base amounts. This is not only for performance but also for db size, code complexity and bank reconciliation.

- to keep and improve, or at lease allow, the possibility of having amls taxes where the tax_base_amount represents the base amount, and the balance represents the tax amount, seems an easy to understand and flexible way to deal with base amounts on many different use cases

- Lastly, I also like the tax_base_amount field on the aml's as it's really easy to audit and check. On one record (the aml) you have all the data you need related to a tax.

by Juan José Scarafía - 10:51 - 8 Jun 2023

Follow-Ups

-

Re: tax_base_amount going to be deprecated. Anyone else using it?

Hi Nhomar!I don't have a PR. It was a conversation with Odoo team (localizations PO) + developer.The "rationale" that I understood from the conversation was:- nowadays, on odoo standard, there is no usage of the tax_base_amount except on the tax audit report view

- on odoo reports, they are considering as the tax_base_amount the amount of the base lines where those taxes where applied. so there could be some difference between the stored tax_base_amount and the one used on reports

- my opinions:

- instead of fixing/improving it, just removing seems easier

- in countries where the tax is send globally, tax_base_amount on the tax line it self makes lot of sense (simpler code, less lines, less complexity, less computations)

- in countries where the taxes are computed and reported by line, may be something different is needed

Example of odoo report where they are not using the tax_base_amount but computing itEl mar, 13 jun 2023 a la(s) 03:52, Nhomar Hernández (notifications@odoo-community.org) escribió:Hello @Juan José ScarafíaCan you share the PR where the deprecation is happening?the complementary account moves are an actual error (in fact if you combine them with the extra 2 lines that every line generate in the chase basis this will be a huge issue)In a few thousand invoices company (not that big) explain those extra moves will be complicated, I can not understand how 1 field vs thousands of lines just for the sake of a consistency that is and should be there is better.But anyways before make any conclusion.Do you have the PR?Do you have the conversation where Odoo's explains the rationale?Regards.El jue, 8 jun 2023 a la(s) 14:52, Juan José Scarafía (notifications@odoo-community.org) escribió:Hello Everyone.It seams that odoo is going to deprecate the not so used field tax_base_amountThe main reason odoo is going to do so is that now it may be inconsistent on how odoo is computing the base amount for a tax (the base for Odoo is always the sum of the balance of the aml's where the tax is applied on the tax_ids field)Together with that field being deprecated, the idea behind is that there shouldn't be any aml (account.move.line) with tax_line_id that was not originated by another aml with tax_idsWe've some use cases where for us it's practical to be able to create tax aml'sSome examples:- bank statements.

- on many banks operations (for eg. check deposits) we have expenses + taxes associated. So for on check deposit we may have 4 statement lines:

- check deposit (cash in)

- expense fee (cash out)

- tax 1 (based on the expense fee, cash out)

- tax 2 (based on the expense fee, cash out)

- On Odoo standard we're not able to reconcile that because we can't say that an statement line is 100% a tax In the odoo approach those two taxes should came from the tax being applied on the "expense fee"

- special invoice taxes

- we've some special invoice taxes where the base amount is not the subtotal of the invoice line but some specific computation (for ex. is the vat of that line)

- in that use case, we're storing the calculated base amount on tax_base_amount. Considering that the base amount is the sum of the subtotales of the lines where the tax is linked, is not correct.

- On master (and I believe 16 two). Odoo has a similar use case for belgium. When you offer a cash discount, no matter if the customer use it or not, the vat is computed on the discounted price. That's why there is a new option on the payment terms and, only for having the right base amount on the invoice, odoo is creating virtual lines (check attachment)

- supplier bills

- It's really common to receive supplier bills with some specific taxes that are totalized and without information on which are the base lines.

- in those use cases creating just a tax line (as it was possible on v12-) would be really handy. Nowadays we're adding that tax on the first invoice line (arbitrary) and then editing the amount on the subtotal section. The computed base amount by odoo on reports doesn't represent anything.

- For us it would make much more sense to add the tax on subtotal by choosing: tax, base amount, and amount. And that would create the aml without any need of linked base lines with tax_ids

- We also have some specific needs related to payment withholdings. Summarizing, when you pay or get paid you receive or apply different kind of withholdings for different amounts.

- This is the ideal for us

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Proffits withholding type 1

Proffits withholding type 1

60

600

4

Proffits withholding type 2

Proffits withholding type 2

80

400

5

Cash

1049

- This is the odoo proposal (to have all the base amounts computed by the tax base lines). Lines 6 till 11 are dummy lines just for the base amounts

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Profits withholding type 1

Profits withholding type 1

60

600

4

Profits withholding type 2

Profits withholding type 2

80

400

5

Cash

1049

6

Base for VAT withholding

VAT withholding

210

7

Negative for base VAT withholding

210

8

Base for Profits withholding type 1

Profits withholding type 1

600

9

Negative for Profits withholding type 1

600

10

Base for Profits withholding type 2

Profits withholding type 2

400

11

Negative for Profits withholding type 2

400

- We also know that in Brazil and some other countries, there are some webservices that returns the base amounts and taxes you need to apply to an invoice, Si in those use cases also the base amount of the tax may not be the sum of subtotals where the tax is applied

Summarizing.- Odoo is working on removint tax_base_amount and enforcing that every aml that represents a tax should be created by some aml with that tax. The base amount of the tax would be the sum of the base lines

- IMHO

- That approach could work but requires a lot of dummy lines (plus and negative) to represent all the possible combinations of tax base amounts. This is not only for performance but also for db size, code complexity and bank reconciliation.

- to keep and improve, or at lease allow, the possibility of having amls taxes where the tax_base_amount represents the base amount, and the balance represents the tax amount, seems an easy to understand and flexible way to deal with base amounts on many different use cases

- Lastly, I also like the tax_base_amount field on the aml's as it's really easy to audit and check. On one record (the aml) you have all the data you need related to a tax.

Anyone else share these thoughts or can show me that my ideas are wrong?Thanks!_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

--Nhomar G Hernández

Vauxoo | CEO

¡Construyamos algo genial!

Cel: +52 (477) 393.3942 | Telegram: nhomar | Twitter: @nhomarMéxico · Venezuela · Costa Rica · Perú

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Juan José Scarafía - 04:35 - 13 Jun 2023 -

Re: tax_base_amount going to be deprecated. Anyone else using it?

Hello @Juan José ScarafíaCan you share the PR where the deprecation is happening?the complementary account moves are an actual error (in fact if you combine them with the extra 2 lines that every line generate in the chase basis this will be a huge issue)In a few thousand invoices company (not that big) explain those extra moves will be complicated, I can not understand how 1 field vs thousands of lines just for the sake of a consistency that is and should be there is better.But anyways before make any conclusion.Do you have the PR?Do you have the conversation where Odoo's explains the rationale?Regards.El jue, 8 jun 2023 a la(s) 14:52, Juan José Scarafía (notifications@odoo-community.org) escribió:Hello Everyone.It seams that odoo is going to deprecate the not so used field tax_base_amountThe main reason odoo is going to do so is that now it may be inconsistent on how odoo is computing the base amount for a tax (the base for Odoo is always the sum of the balance of the aml's where the tax is applied on the tax_ids field)Together with that field being deprecated, the idea behind is that there shouldn't be any aml (account.move.line) with tax_line_id that was not originated by another aml with tax_idsWe've some use cases where for us it's practical to be able to create tax aml'sSome examples:- bank statements.

- on many banks operations (for eg. check deposits) we have expenses + taxes associated. So for on check deposit we may have 4 statement lines:

- check deposit (cash in)

- expense fee (cash out)

- tax 1 (based on the expense fee, cash out)

- tax 2 (based on the expense fee, cash out)

- On Odoo standard we're not able to reconcile that because we can't say that an statement line is 100% a tax In the odoo approach those two taxes should came from the tax being applied on the "expense fee"

- special invoice taxes

- we've some special invoice taxes where the base amount is not the subtotal of the invoice line but some specific computation (for ex. is the vat of that line)

- in that use case, we're storing the calculated base amount on tax_base_amount. Considering that the base amount is the sum of the subtotales of the lines where the tax is linked, is not correct.

- On master (and I believe 16 two). Odoo has a similar use case for belgium. When you offer a cash discount, no matter if the customer use it or not, the vat is computed on the discounted price. That's why there is a new option on the payment terms and, only for having the right base amount on the invoice, odoo is creating virtual lines (check attachment)

- supplier bills

- It's really common to receive supplier bills with some specific taxes that are totalized and without information on which are the base lines.

- in those use cases creating just a tax line (as it was possible on v12-) would be really handy. Nowadays we're adding that tax on the first invoice line (arbitrary) and then editing the amount on the subtotal section. The computed base amount by odoo on reports doesn't represent anything.

- For us it would make much more sense to add the tax on subtotal by choosing: tax, base amount, and amount. And that would create the aml without any need of linked base lines with tax_ids

- We also have some specific needs related to payment withholdings. Summarizing, when you pay or get paid you receive or apply different kind of withholdings for different amounts.

- This is the ideal for us

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Proffits withholding type 1

Proffits withholding type 1

60

600

4

Proffits withholding type 2

Proffits withholding type 2

80

400

5

Cash

1049

- This is the odoo proposal (to have all the base amounts computed by the tax base lines). Lines 6 till 11 are dummy lines just for the base amounts

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Profits withholding type 1

Profits withholding type 1

60

600

4

Profits withholding type 2

Profits withholding type 2

80

400

5

Cash

1049

6

Base for VAT withholding

VAT withholding

210

7

Negative for base VAT withholding

210

8

Base for Profits withholding type 1

Profits withholding type 1

600

9

Negative for Profits withholding type 1

600

10

Base for Profits withholding type 2

Profits withholding type 2

400

11

Negative for Profits withholding type 2

400

- We also know that in Brazil and some other countries, there are some webservices that returns the base amounts and taxes you need to apply to an invoice, Si in those use cases also the base amount of the tax may not be the sum of subtotals where the tax is applied

Summarizing.- Odoo is working on removint tax_base_amount and enforcing that every aml that represents a tax should be created by some aml with that tax. The base amount of the tax would be the sum of the base lines

- IMHO

- That approach could work but requires a lot of dummy lines (plus and negative) to represent all the possible combinations of tax base amounts. This is not only for performance but also for db size, code complexity and bank reconciliation.

- to keep and improve, or at lease allow, the possibility of having amls taxes where the tax_base_amount represents the base amount, and the balance represents the tax amount, seems an easy to understand and flexible way to deal with base amounts on many different use cases

- Lastly, I also like the tax_base_amount field on the aml's as it's really easy to audit and check. On one record (the aml) you have all the data you need related to a tax.

Anyone else share these thoughts or can show me that my ideas are wrong?Thanks!_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

--Nhomar G Hernández

Vauxoo | CEO

¡Construyamos algo genial!

Cel: +52 (477) 393.3942 | Telegram: nhomar | Twitter: @nhomarMéxico · Venezuela · Costa Rica · Perú

by Nhomar Hernández - 08:51 - 13 Jun 2023 -

Re: tax_base_amount going to be deprecated. Anyone else using it?

Hi Juan,I'm also from Argentina so we use it too. I agree with all your points and I really don't like the suggested "way" of doing it that Odoo is proposing.The deprecation of this field is a final decision? I think we will need to find a new approach to this, since all those dummy lines are confusing even for accounting people.On Thu, Jun 8, 2023 at 5:52 PM Juan José Scarafía <notifications@odoo-community.org> wrote:Hello Everyone.It seams that odoo is going to deprecate the not so used field tax_base_amountThe main reason odoo is going to do so is that now it may be inconsistent on how odoo is computing the base amount for a tax (the base for Odoo is always the sum of the balance of the aml's where the tax is applied on the tax_ids field)Together with that field being deprecated, the idea behind is that there shouldn't be any aml (account.move.line) with tax_line_id that was not originated by another aml with tax_idsWe've some use cases where for us it's practical to be able to create tax aml'sSome examples:- bank statements.

- on many banks operations (for eg. check deposits) we have expenses + taxes associated. So for on check deposit we may have 4 statement lines:

- check deposit (cash in)

- expense fee (cash out)

- tax 1 (based on the expense fee, cash out)

- tax 2 (based on the expense fee, cash out)

- On Odoo standard we're not able to reconcile that because we can't say that an statement line is 100% a tax In the odoo approach those two taxes should came from the tax being applied on the "expense fee"

- special invoice taxes

- we've some special invoice taxes where the base amount is not the subtotal of the invoice line but some specific computation (for ex. is the vat of that line)

- in that use case, we're storing the calculated base amount on tax_base_amount. Considering that the base amount is the sum of the subtotales of the lines where the tax is linked, is not correct.

- On master (and I believe 16 two). Odoo has a similar use case for belgium. When you offer a cash discount, no matter if the customer use it or not, the vat is computed on the discounted price. That's why there is a new option on the payment terms and, only for having the right base amount on the invoice, odoo is creating virtual lines (check attachment)

- supplier bills

- It's really common to receive supplier bills with some specific taxes that are totalized and without information on which are the base lines.

- in those use cases creating just a tax line (as it was possible on v12-) would be really handy. Nowadays we're adding that tax on the first invoice line (arbitrary) and then editing the amount on the subtotal section. The computed base amount by odoo on reports doesn't represent anything.

- For us it would make much more sense to add the tax on subtotal by choosing: tax, base amount, and amount. And that would create the aml without any need of linked base lines with tax_ids

- We also have some specific needs related to payment withholdings. Summarizing, when you pay or get paid you receive or apply different kind of withholdings for different amounts.

- This is the ideal for us

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Proffits withholding type 1

Proffits withholding type 1

60

600

4

Proffits withholding type 2

Proffits withholding type 2

80

400

5

Cash

1049

- This is the odoo proposal (to have all the base amounts computed by the tax base lines). Lines 6 till 11 are dummy lines just for the base amounts

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Profits withholding type 1

Profits withholding type 1

60

600

4

Profits withholding type 2

Profits withholding type 2

80

400

5

Cash

1049

6

Base for VAT withholding

VAT withholding

210

7

Negative for base VAT withholding

210

8

Base for Profits withholding type 1

Profits withholding type 1

600

9

Negative for Profits withholding type 1

600

10

Base for Profits withholding type 2

Profits withholding type 2

400

11

Negative for Profits withholding type 2

400

- We also know that in Brazil and some other countries, there are some webservices that returns the base amounts and taxes you need to apply to an invoice, Si in those use cases also the base amount of the tax may not be the sum of subtotals where the tax is applied

Summarizing.- Odoo is working on removint tax_base_amount and enforcing that every aml that represents a tax should be created by some aml with that tax. The base amount of the tax would be the sum of the base lines

- IMHO

- That approach could work but requires a lot of dummy lines (plus and negative) to represent all the possible combinations of tax base amounts. This is not only for performance but also for db size, code complexity and bank reconciliation.

- to keep and improve, or at lease allow, the possibility of having amls taxes where the tax_base_amount represents the base amount, and the balance represents the tax amount, seems an easy to understand and flexible way to deal with base amounts on many different use cases

- Lastly, I also like the tax_base_amount field on the aml's as it's really easy to audit and check. On one record (the aml) you have all the data you need related to a tax.

Anyone else share these thoughts or can show me that my ideas are wrong?Thanks!_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Nicolas Rodriguez Sande - 02:11 - 13 Jun 2023 -

Re: tax_base_amount going to be deprecated. Anyone else using it?

Hi Richard!Thanks, I believe we've a similar need. On imports we register "purchase bills" for the import import clearance where you only pay taxes.What we're doing till now is adding invoice lines that represent each base amount with the corresponding taxes and later on negative lines to balance the.Indeed doing what you said could work but we wouldn't have the tax_base_amout (and we needed for later tax declaration)Thanks!El jue, 8 jun 2023 a la(s) 23:01, Richard deMeester (notifications@odoo-community.org) escribió:Hi Juan,

We used to generate tax lines for import charges as a tax only line.

When ordering products from foreign sources, a tax may be applied by the customs at time of import.

This tax is payable directly to the point of import, and is not associated with any lines.

We introduced a change to l10n_au (now included in Odoo enterprise) which defines an import tax:

au_tax_purchase_taxable_import

Which has is a tax included tax with a 100000000000 percent value.

This effectively allows a line on the invoice for a large figure, and with rounding, Odoo determines the base value as being the fraction of a cent and the whole amount ends up as tax, and then ends up in reporting, linked to an invoice line that has no real value.

Hope this gives you some ideas.

Richard

Kind Regards

T: (03) 9135 1900 | M: 0403 76 76 76 | A: Bld 10/435 Williamstown Road, Port Melbourne, 3207

MAKING GROWTH THROUGH TECHNOLOGY EASY

Notice: This email and any files transmitted with it are confidential and are intended solely for the use of the individual or entity to which they are addressed. If you are not the intended recipient, you may not disclose or use the information in this email in any way. If you have received this email in error please notify the sender. Although reasonable precautions have been taken to ensure no viruses are present in this email, no responsibility is accepted by WilldooIT Pty Ltd or its related entities for any loss or damage arising from the use of this email or attachments. Any views expressed in this email or file attachments are those of the individual sender only, unless expressly stated to be those of WilldooIT Pty Ltd ABN 85 006 073 052 or any of its related entities.

From: Juan José Scarafía <notifications@odoo-community.org>

Sent: Friday, 9 June 2023 6:52 AM

To: Contributors <contributors@odoo-community.org>

Subject: tax_base_amount going to be deprecated. Anyone else using it?Hello Everyone.It seams that odoo is going to deprecate the not so used field tax_base_amountThe main reason odoo is going to do so is that now it may be inconsistent on how odoo is computing the base amount for a tax (the base for Odoo is always the sum of the balance of the aml's where the tax is applied on the tax_ids field)

Together with that field being deprecated, the idea behind is that there shouldn't be any aml (account.move.line) with tax_line_id that was not originated by another aml with tax_ids

We've some use cases where for us it's practical to be able to create tax aml'sSome examples:- bank statements.

- on many banks operations (for eg. check deposits) we have expenses + taxes associated. So for on check deposit we may have 4 statement lines:

- check deposit (cash in)

- expense fee (cash out)

- tax 1 (based on the expense fee, cash out)

- tax 2 (based on the expense fee, cash out)

- On Odoo standard we're not able to reconcile that because we can't say that an statement line is 100% a tax In the odoo approach those two taxes should came from the tax being applied on the "expense fee"

- special invoice taxes

- we've some special invoice taxes where the base amount is not the subtotal of the invoice line but some specific computation (for ex. is the vat of that line)

- in that use case, we're storing the calculated base amount on tax_base_amount. Considering that the base amount is the sum of the subtotales of the lines where the tax is linked, is not correct.

- On master (and I believe 16 two). Odoo has a similar use case for belgium. When you offer a cash discount, no matter if the customer use it or not, the vat is computed on the discounted price. That's why there is a new option on the payment terms and, only for having the right base amount on the invoice, odoo is creating virtual lines (check attachment)

- supplier bills

- It's really common to receive supplier bills with some specific taxes that are totalized and without information on which are the base lines.

- in those use cases creating just a tax line (as it was possible on v12-) would be really handy. Nowadays we're adding that tax on the first invoice line (arbitrary) and then editing the amount on the subtotal section. The computed base amount by odoo on reports doesn't represent anything.

- For us it would make much more sense to add the tax on subtotal by choosing: tax, base amount, and amount. And that would create the aml without any need of linked base lines with tax_ids

- We also have some specific needs related to payment withholdings. Summarizing, when you pay or get paid you receive or apply different kind of withholdings for different amounts.

- This is the ideal for us

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Proffits withholding type 1

Proffits withholding type 1

60

600

4

Proffits withholding type 2

Proffits withholding type 2

80

400

5

Cash

1049

- This is the odoo proposal (to have all the base amounts computed by the tax base lines). Lines 6 till 11 are dummy lines just for the base amounts

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Profits withholding type 1

Profits withholding type 1

60

600

4

Profits withholding type 2

Profits withholding type 2

80

400

5

Cash

1049

6

Base for VAT withholding

VAT withholding

210

7

Negative for base VAT withholding

210

8

Base for Profits withholding type 1

Profits withholding type 1

600

9

Negative for Profits withholding type 1

600

10

Base for Profits withholding type 2

Profits withholding type 2

400

11

Negative for Profits withholding type 2

400

- We also know that in Brazil and some other countries, there are some webservices that returns the base amounts and taxes you need to apply to an invoice, Si in those use cases also the base amount of the tax may not be the sum of subtotals where the tax is applied

Summarizing.- Odoo is working on removint tax_base_amount and enforcing that every aml that represents a tax should be created by some aml with that tax. The base amount of the tax would be the sum of the base lines

- IMHO

- That approach could work but requires a lot of dummy lines (plus and negative) to represent all the possible combinations of tax base amounts. This is not only for performance but also for db size, code complexity and bank reconciliation.

- to keep and improve, or at lease allow, the possibility of having amls taxes where the tax_base_amount represents the base amount, and the balance represents the tax amount, seems an easy to understand and flexible way to deal with base amounts on many different use cases

- Lastly, I also like the tax_base_amount field on the aml's as it's really easy to audit and check. On one record (the aml) you have all the data you need related to a tax.

Anyone else share these thoughts or can show me that my ideas are wrong?Thanks!

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Juan José Scarafía - 10:00 - 10 Jun 2023 -

Re: tax_base_amount going to be deprecated. Anyone else using it?

Hi Juan,

We used to generate tax lines for import charges as a tax only line.

When ordering products from foreign sources, a tax may be applied by the customs at time of import.

This tax is payable directly to the point of import, and is not associated with any lines.

We introduced a change to l10n_au (now included in Odoo enterprise) which defines an import tax:

au_tax_purchase_taxable_import

Which has is a tax included tax with a 100000000000 percent value.

This effectively allows a line on the invoice for a large figure, and with rounding, Odoo determines the base value as being the fraction of a cent and the whole amount ends up as tax, and then ends up in reporting, linked to an invoice line that has no real value.

Hope this gives you some ideas.

Richard

Kind Regards

T: (03) 9135 1900 | M: 0403 76 76 76 | A: Bld 10/435 Williamstown Road, Port Melbourne, 3207

MAKING GROWTH THROUGH TECHNOLOGY EASY

Notice: This email and any files transmitted with it are confidential and are intended solely for the use of the individual or entity to which they are addressed. If you are not the intended recipient, you may not disclose or use the information in this email in any way. If you have received this email in error please notify the sender. Although reasonable precautions have been taken to ensure no viruses are present in this email, no responsibility is accepted by WilldooIT Pty Ltd or its related entities for any loss or damage arising from the use of this email or attachments. Any views expressed in this email or file attachments are those of the individual sender only, unless expressly stated to be those of WilldooIT Pty Ltd ABN 85 006 073 052 or any of its related entities.

From: Juan José Scarafía <notifications@odoo-community.org>

Sent: Friday, 9 June 2023 6:52 AM

To: Contributors <contributors@odoo-community.org>

Subject: tax_base_amount going to be deprecated. Anyone else using it?Hello Everyone.It seams that odoo is going to deprecate the not so used field tax_base_amountThe main reason odoo is going to do so is that now it may be inconsistent on how odoo is computing the base amount for a tax (the base for Odoo is always the sum of the balance of the aml's where the tax is applied on the tax_ids field)

Together with that field being deprecated, the idea behind is that there shouldn't be any aml (account.move.line) with tax_line_id that was not originated by another aml with tax_ids

We've some use cases where for us it's practical to be able to create tax aml'sSome examples:- bank statements.

- on many banks operations (for eg. check deposits) we have expenses + taxes associated. So for on check deposit we may have 4 statement lines:

- check deposit (cash in)

- expense fee (cash out)

- tax 1 (based on the expense fee, cash out)

- tax 2 (based on the expense fee, cash out)

- On Odoo standard we're not able to reconcile that because we can't say that an statement line is 100% a tax In the odoo approach those two taxes should came from the tax being applied on the "expense fee"

- special invoice taxes

- we've some special invoice taxes where the base amount is not the subtotal of the invoice line but some specific computation (for ex. is the vat of that line)

- in that use case, we're storing the calculated base amount on tax_base_amount. Considering that the base amount is the sum of the subtotales of the lines where the tax is linked, is not correct.

- On master (and I believe 16 two). Odoo has a similar use case for belgium. When you offer a cash discount, no matter if the customer use it or not, the vat is computed on the discounted price. That's why there is a new option on the payment terms and, only for having the right base amount on the invoice, odoo is creating virtual lines (check attachment)

- supplier bills

- It's really common to receive supplier bills with some specific taxes that are totalized and without information on which are the base lines.

- in those use cases creating just a tax line (as it was possible on v12-) would be really handy. Nowadays we're adding that tax on the first invoice line (arbitrary) and then editing the amount on the subtotal section. The computed base amount by odoo on reports doesn't represent anything.

- For us it would make much more sense to add the tax on subtotal by choosing: tax, base amount, and amount. And that would create the aml without any need of linked base lines with tax_ids

- We also have some specific needs related to payment withholdings. Summarizing, when you pay or get paid you receive or apply different kind of withholdings for different amounts.

- This is the ideal for us

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Proffits withholding type 1

Proffits withholding type 1

60

600

4

Proffits withholding type 2

Proffits withholding type 2

80

400

5

Cash

1049

- This is the odoo proposal (to have all the base amounts computed by the tax base lines). Lines 6 till 11 are dummy lines just for the base amounts

#

account

tax_ids

tax_id

debit

credit

tax_base_amount

1

Suppliers

1210

2

VAT withholding

VAT withholding

21

210

3

Profits withholding type 1

Profits withholding type 1

60

600

4

Profits withholding type 2

Profits withholding type 2

80

400

5

Cash

1049

6

Base for VAT withholding

VAT withholding

210

7

Negative for base VAT withholding

210

8

Base for Profits withholding type 1

Profits withholding type 1

600

9

Negative for Profits withholding type 1

600

10

Base for Profits withholding type 2

Profits withholding type 2

400

11

Negative for Profits withholding type 2

400

- We also know that in Brazil and some other countries, there are some webservices that returns the base amounts and taxes you need to apply to an invoice, Si in those use cases also the base amount of the tax may not be the sum of subtotals where the tax is applied

Summarizing.- Odoo is working on removint tax_base_amount and enforcing that every aml that represents a tax should be created by some aml with that tax. The base amount of the tax would be the sum of the base lines

- IMHO

- That approach could work but requires a lot of dummy lines (plus and negative) to represent all the possible combinations of tax base amounts. This is not only for performance but also for db size, code complexity and bank reconciliation.

- to keep and improve, or at lease allow, the possibility of having amls taxes where the tax_base_amount represents the base amount, and the balance represents the tax amount, seems an easy to understand and flexible way to deal with base amounts on many different use cases

- Lastly, I also like the tax_base_amount field on the aml's as it's really easy to audit and check. On one record (the aml) you have all the data you need related to a tax.

Anyone else share these thoughts or can show me that my ideas are wrong?Thanks!

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by "Richard deMeester" <richard.demeester@willdooit.com> - 04:01 - 9 Jun 2023